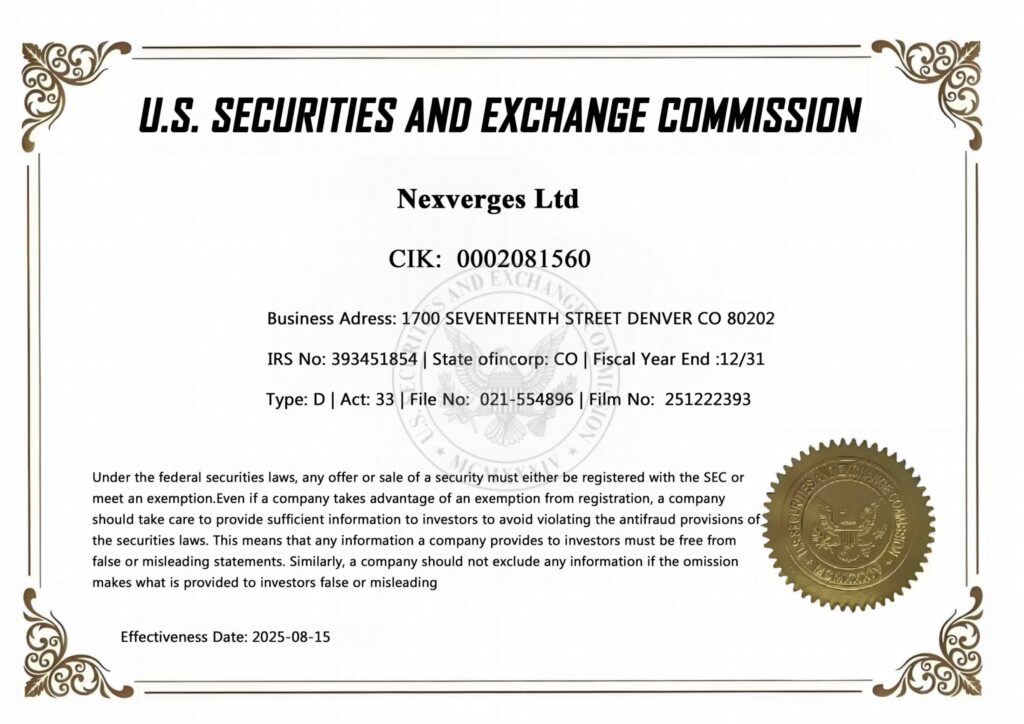

Our Compliance Commitment

Nexverges operates under a compliance-first model for digital assets, ensuring transparency, security, and integrity.

The platform operates under applicable U.S. SEC exemptions, maintaining strict adherence to international compliance standards. It implements thorough KYC and AML procedures to verify users and prevent illicit activity, while advanced geolocation safeguards restrict access from sanctioned or high-risk regions in accordance with global regulatory requirements.

Licensing & Regulatory Framework

- Registered under U.S. SEC exemptions: Regulation D and Regulation S.

- Full compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

- IP/geolocation controls to block access from OFAC-sanctioned and restricted regions.

Security & Oversight

- Independent audits of smart contracts and custody processes.

- SOC-aligned operational standards and continuous anomaly detection.

- Withdrawal allowlists and real-time monitoring for suspicious activity.

Nexverges Ltd is committed to building a fully compliant equity trading infrastructure in the United States. Our registration with the SEC and FINRA reflects our dedication to regulatory transparency, investor protection, and institutional-grade operational standards.